Expert Tax Planning To Help YOU Save Money on Taxes

Tax Preparation does NOT equal Tax Planning! If your accountant has only ever prepared your taxes, but never dug deep into tax planning, you are likely paying more than your fair share of taxes.

No one should pay $1 more in taxes than they are legally required to pay! Schedule a call with our tax planning experts to find ways to legally lower your tax liability today.

Expert Tax Planning To Help YOU Save Money on Taxes

Tax Preparation does NOT equal Tax Planning! If your accountant has only ever prepared your taxes, but never dug deep into tax planning, you are likely paying more than your fair share of taxes.

No one should pay $1 more in taxes than they are legally required to pay! Schedule a call with our tax planning experts to find ways to legally lower your tax liability today.

Meet Mark Sharman, CPA

FOUNDER + TAX PLANNER + CFO CONSULTANT

Husband to Ruth. Father of 8 Beautiful Girls. Mark founded this firm in 2013.

He has a Bachelor’s in Business, Master’s in Accounting and Financial Management, and is a licensed CPA.

Mark has had his hand in every aspect of Accounting and Tax Services through the years, but currently focuses on maximizing client’s Tax Savings and Net Profits through Tax Planning and CFO Consulting. He is passionate about making a difference in the lives and businesses of his clients by helping them realize their goals and dreams that led them to be an entrepreneur in the first place.

Meet Mark Sharman, CPA

FOUNDER + TAX PLANNER + CFO CONSULTANT

Husband to Ruth. Father of 6 Beautiful Girls. Passionate Disciple of Jesus. Mark founded this firm in 2013. He has a Bachelor’s in Business, Master’s in Accounting and Financial Management, Master’s in Theology, and is a licensed CPA. Mark has had his hand in every aspect of Accounting and Tax Services through the years, but currently focuses on maximizing client’s Tax Savings and Net Profits through Tax Planning and CFO Consulting. He is passionate about making a difference in the lives and businesses of his clients by helping them realize their goals and dreams that led them to be an entrepreneur in the first place.

Navigate Your Taxes With Help From Expert CPAs

Ever felt like you are paying too much in taxes? Most business owners who come to us have overpaid taxes for years. We provide our clients with a comprehensive tax planning review of their life, business, and regulatory requirements to legally reduce taxes. We review:

Amended Previous Year Filings (where our clients often receive thousands in tax refunds)

Deductions

Legal Entity Structure

Retirement

Business Loopholes

Regulatory Changes

Niche Specific Strategies

Advanced Strategies

We're experts in all aspects of tax and business finance

Proactive Tax Planning

Our tax experts focus on proactively implementing key tax savings strategies to help lower your tax burden each year.

Legislative Changes

Stay on top of the latest legislation changes and understand how they may affect you this year and every year moving forward.

Certified Public Accountants

Our CPAs, continually train and research to help you navigate the changing laws.

Correct Tax Mistakes

Most tax preparers focus solely on data entry only to submit your return as quickly as possible, making critical, higher-level mistakes. We can help.

Plan Quarterly Tax Payments

Let us help you proactively stay on top of your tax liability and help lower your tax bill each quarter.

Comprehensive Review

We review Deductions, Legal Entity Structure, Insurance, Retirement, Loopholes, Regulatory Changes, Niche Strategies &, Advanced Strategies.

Navigate Your Taxes With Help From Expert CPAs

Ever felt like you are paying too much in taxes? Most business owners who come to us have overpaid taxes for years. We provide our clients with a comprehensive tax planning review of their life, business, and regulatory requirements to legally reduce taxes. We review:

Amended Previous Year Filings (where our clients often receive thousands in tax refunds)

Deductions

Legal Entity Structure

Retirement

Business Loopholes

Regulatory Changes

Niche Specific Strategies

Advanced Strategies

We're experts in all aspects of tax and business finance

Proactive Tax Planning

Our tax experts focus on proactively implementing key tax savings strategies to help lower your tax burden each year.

Legislative Changes

Stay on top of the latest legislation changes and understand how they may affect you this year and every year moving forward.

Certified Public Accountants

Our CPAs, continually train and research to help you navigate the changing laws.

Correct Tax Mistakes

Most tax preparers focus solely on data entry only to submit your return as quickly as possible, making critical, higher-level mistakes. We can help.

Plan Quarterly Tax Payments

Let us help you proactively stay on top of your tax liability and help lower your tax bill each quarter.

Comprehensive Review

We review Deductions, Legal Entity Structure, Insurance, Retirement, Loopholes, Regulatory Changes, Niche Strategies &, Advanced Strategies.

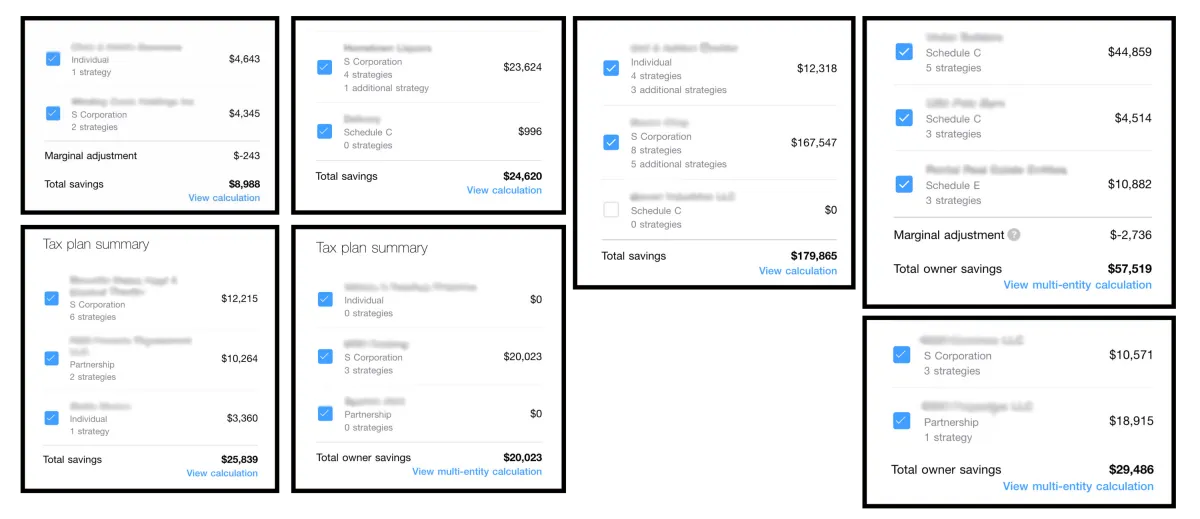

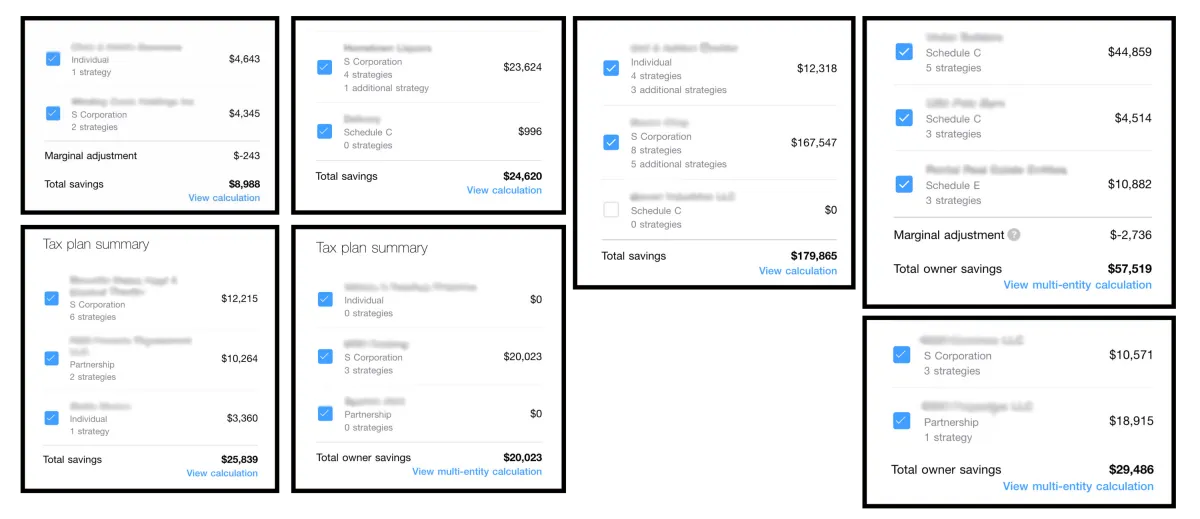

Success Stories from Our Clients:

We have helped many people this year save tens of thousands in taxes. Here are just three:

A W2 employee + Sch E Rental with income of $329,078 saved $24,488 in 2021, 2022, and beyond

A Real Estate Agent with income of $172,545 saved $24,761 in 2021, 2022, and beyond

A Real Estate Investor with income of $347,445 saved $68,445 in 2021, 2022, and beyond

"He falls into that rare category of genius"

"I have worked with many accountants over the years. Mark is by far the best. He's not just good with accounting, but strangely enjoys it. He is high character, has a great sense of humor, and a really cool Aussie accent. He falls into that rare category of genius. He is able to study your unique business situation and propose solutions that greatly improve your model and your tax situation. I highly recommend Mark and his team."

- Eric Ludy

Tax Planning and CFO Consulting Services that Help YOU Drive Profits and Save on Taxes.

Tax Planning

Tax Preparation

Entity Formation

Asset Protection

Wealth Management

Outsourced Chief Financial Officer

Monthly Accounting

Business Cleanup

Success Stories from Our Clients:

We have helped many people this year save tens of thousands in taxes. Here are just three:

A W2 employee + Sch E Rental with income of $329,078 saved $24,488 in 2021, 2022, and beyond

A Real Estate Agent with income of $172,545 saved $24,761 in 2021, 2022, and beyond

A Real Estate Investor with income of $347,445 saved $68,445 in 2021, 2022, and beyond

"He falls into that rare category of genius"

"I have worked with many accountants over the years. Mark is by far the best. He's not just good with accounting, but strangely enjoys it. He is high character, has a great sense of humor, and a really cool Aussie accent. He falls into that rare category of genius. He is able to study your unique business situation and propose solutions that greatly improve your model and your tax situation. I highly recommend Mark and his team."

- Eric Ludy

Tax Planning and CFO Consulting Services that Help YOU Drive Profits and Save on Taxes.

Tax Planning

Tax Preparation

Entity Formation

Asset Protection

Wealth Management

Outsourced Chief Financial Officer

Monthly Accounting

Business Cleanup

Real Customer Results

Real Customer Results